|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Refinance Loan Limits for HomeownersIntroduction to FHA Refinance LoansFHA refinance loans are a popular option for homeowners looking to reduce their monthly payments or switch their loan terms. These loans are backed by the Federal Housing Administration, making them accessible to many borrowers. Understanding the loan limits is crucial for homeowners considering this refinancing option. What Are FHA Refinance Loan Limits?Loan limits define the maximum amount a borrower can finance with an FHA loan. These limits vary based on location and property type. Determining Factors

Benefits of Knowing Your Loan LimitsUnderstanding FHA loan limits can significantly impact your refinancing strategy.

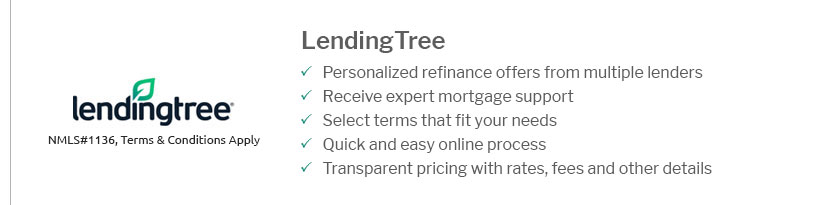

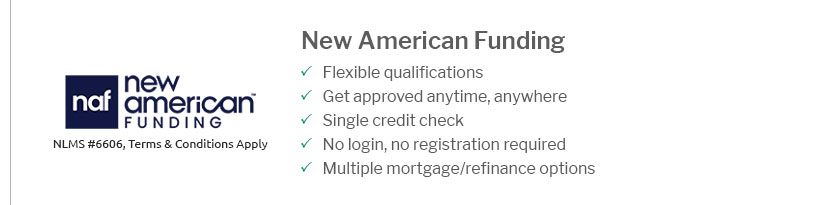

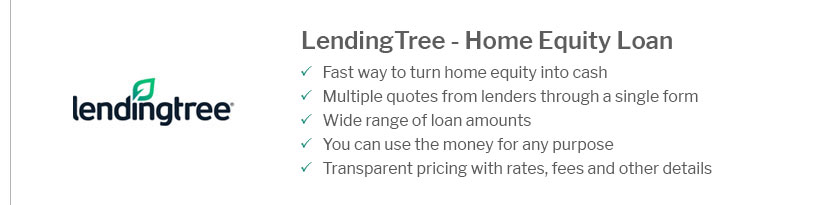

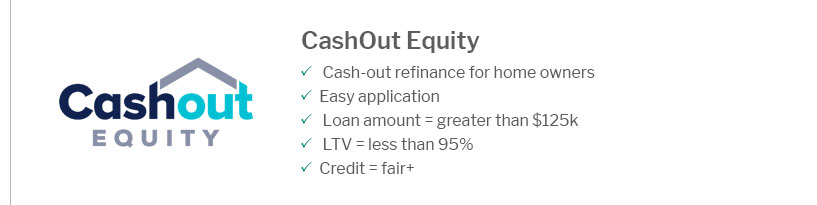

For those seeking more specific advice, consulting with mortgage lenders in Charleston SC can provide tailored guidance. How to Calculate Your Loan LimitUsing Online ToolsNumerous online calculators can provide quick estimates of your FHA loan limits based on your location and property type. Consulting with ProfessionalsEngaging with financial advisors or lenders can offer precise calculations and professional insights. FAQ: FHA Refinance Loan LimitsConclusion: Making Informed DecisionsBeing informed about FHA refinance loan limits is essential for making strategic financial decisions. Homeowners are encouraged to explore resources and consult with experts, possibly the best company to refinance with, to optimize their refinancing process. http://www.hud.gov/program_offices/housing/sfh/lender/origination/mortgage_limits

FHA's nationwide forward mortgage limit "floor" and "ceiling" for a one-unit property in CY 2025 are $524,225 and $1, 209,750, respectively. Select the links ... https://www.bankrate.com/mortgages/fha-loan-limits/

2025 FHA lending limits ... For single-family home loans this year, the FHA loan limits range from a floor of $524,225 to a ceiling of $1,209,750. https://www.fha.com/fha_article?id=587

The borrower is required to make a minimum down payment on all new purchase FHA mortgage loans (3.5%). The maximum financing allowed is 96.5%.

|

|---|